mHealth Apps Statistics: mHealth apps are digital solutions designed for mobile devices like smartphones and tablets, enabling users to manage their health, track fitness progress, monitor medical conditions, and enhance overall well-being. These apps provide a variety of features, including step tracking, heart rate monitoring, calorie counting, medication reminders, telemedicine services, chronic disease management, and even virtual consultations with healthcare professionals.

As mobile technology advances, health apps have become integral to everyday life, encouraging healthier habits and improving access to medical care. To demonstrate the impact of these apps on people’s fitness journey, we have compiled some trending statistics to showcase how they are transforming health management.

Editor’s Choice

- In 2024, 43% of the U.S. population actively used health apps, highlighting the increasing adoption of digital health solutions.

- In comparison, approximately 70% of India’s population uses apps that track nutrition, symptoms, or medication, indicating widespread acceptance of mHealth in the country. As usage grows, healthcare is becoming more personalized and patient-centric.

- MyFitnessPal, Headspace, and Calm dominate the market, with millions of users utilizing these apps to achieve fitness, wellness, and mental health objectives.

- Despite the rapid growth, 71% of health apps still have at least one significant security vulnerability, emphasizing the ongoing need for stronger privacy protections.

- With AI and big data advancements, mHealth apps increasingly incorporate predictive analytics to deliver more personalized health recommendations.

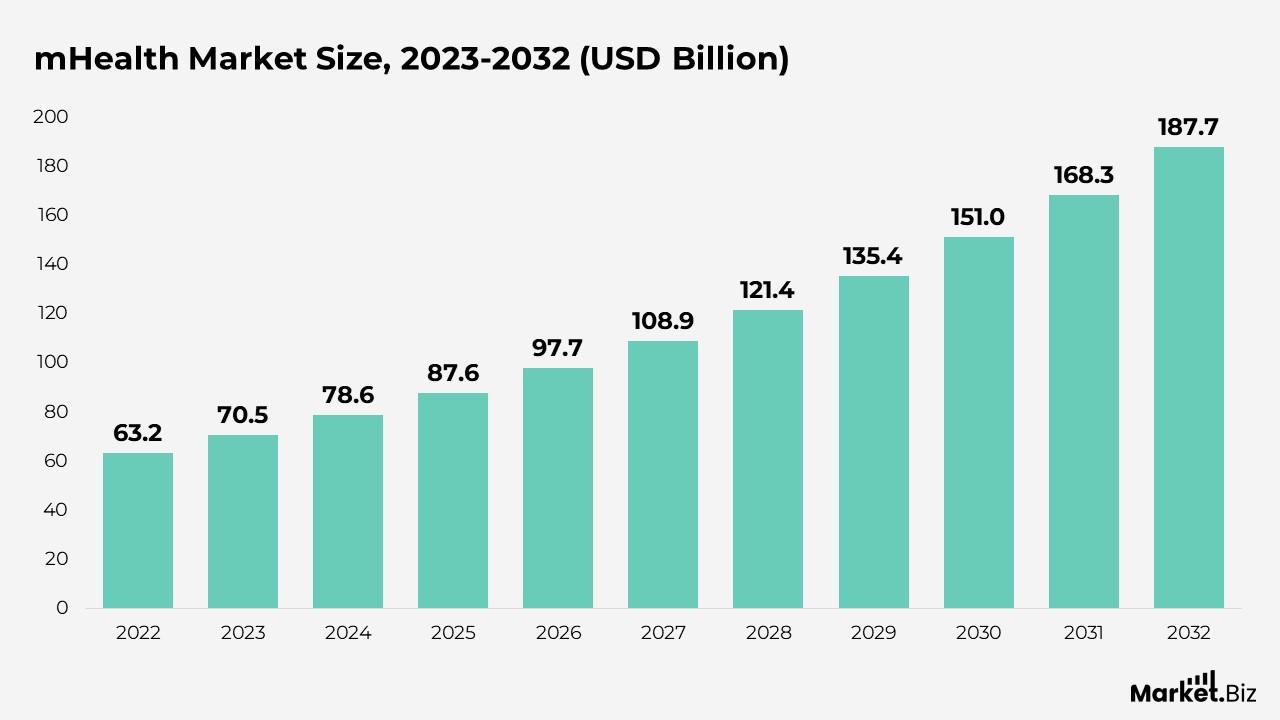

mHealth Market Size

- The global mHealth market is projected to grow from $78.6 billion in 2025 to $168.3 billion by 2033, with a CAGR of 11.5% from 2023 to 2033.

- The mHealth market is fueled by smartphone adoption, increasing health awareness, and rising demand for remote monitoring solutions.

- In 2023, mHealth apps dominated the market with a 74.4% share, offering personalized functionalities that cater to diverse user needs.

- The monitoring services captured over 62.4% of the market in 2023, providing vital real-time health tracking for patients and healthcare providers.

- The Mobile operators held a 47.2% market share in 2023, supporting mHealth services through strong infrastructure and extensive network coverage.

- North America led the mHealth market with 36.8% of revenue in 2023, fueled by high healthcare spending, chronic disease prevalence, and strong network infrastructure.

(Source: Market.us)

mHealth App Statistics

mHealth encompasses health and wellness, remote patient monitoring, and health information and education. This technology has the potential to enhance the healthcare system by increasing efficiency, improving communication, reducing costs, and elevating the quality of healthcare services. With the widespread availability of smartphones, particularly in developed countries, mHealth makes healthcare more accessible and convenient for users.

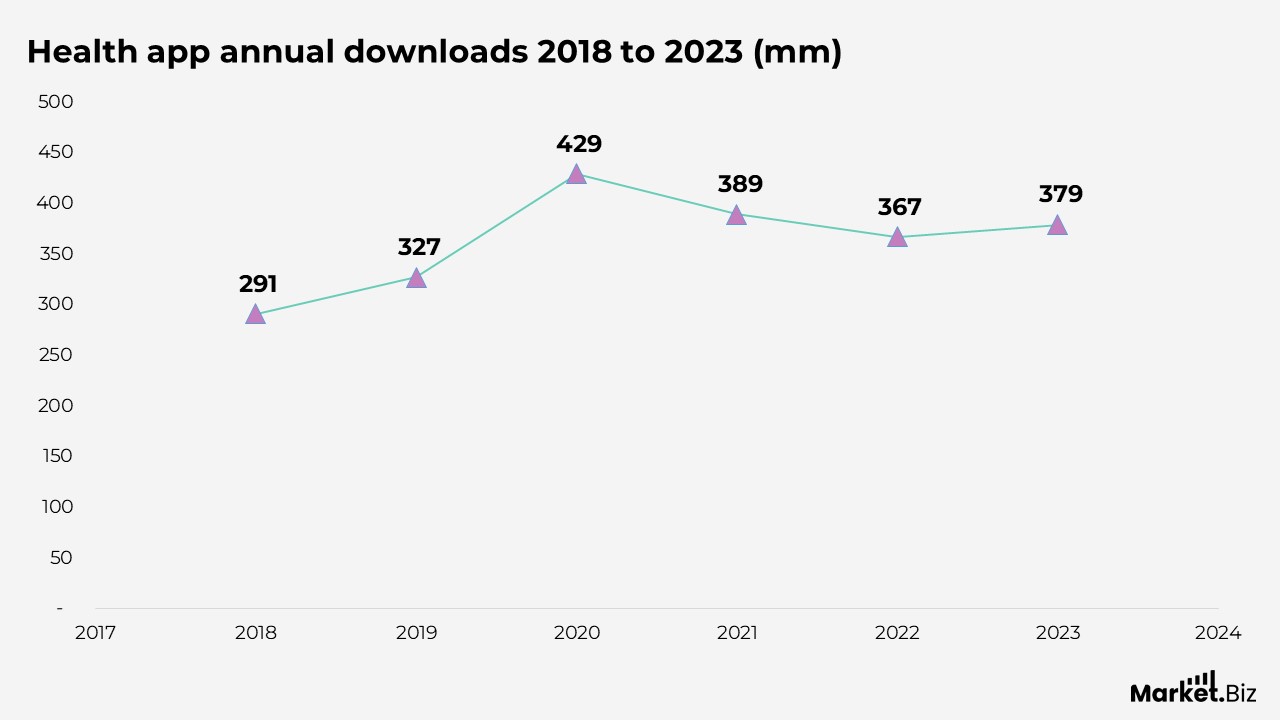

- The health app industry reached $3.43 billion in revenue in 2023, marking a 9.9% growth compared to 2022.

- By 2023, there were 311 millionhealth app users globally, indicating a significant expansion in adopting mobile health solutions.

- In 2023, health apps were downloaded 379 million times, demonstrating their growing popularity and widespread use.

- Currently, more than 350,000 mobile health apps are available, with many designed to help manage chronic conditions like type 2 diabetes. These apps often integrate with other monitoring technologies, such as continuous glucose monitors (CGMs).

(Source: Business of Apps, Statista)

Reasons For Downloading Health Apps

- 73% of users independently downloaded health apps, demonstrating a strong personal interest in utilizing digital tools for health and wellness management.

- 22% of users chose health apps following recommendations from family and friends, underscoring the impact of personal connections and trusted advice in health-related decisions.

- 16% of users opted for health apps based on guidance from healthcare providers, suggesting that medical professionals play a key role in influencing health technology adoption.

- 7% of users downloaded health apps after receiving suggestions from their insurance companies, reflecting the increasing role of insurers in promoting digital health solutions for improved patient outcomes and cost efficiency.

(Source: Medium Corporation)

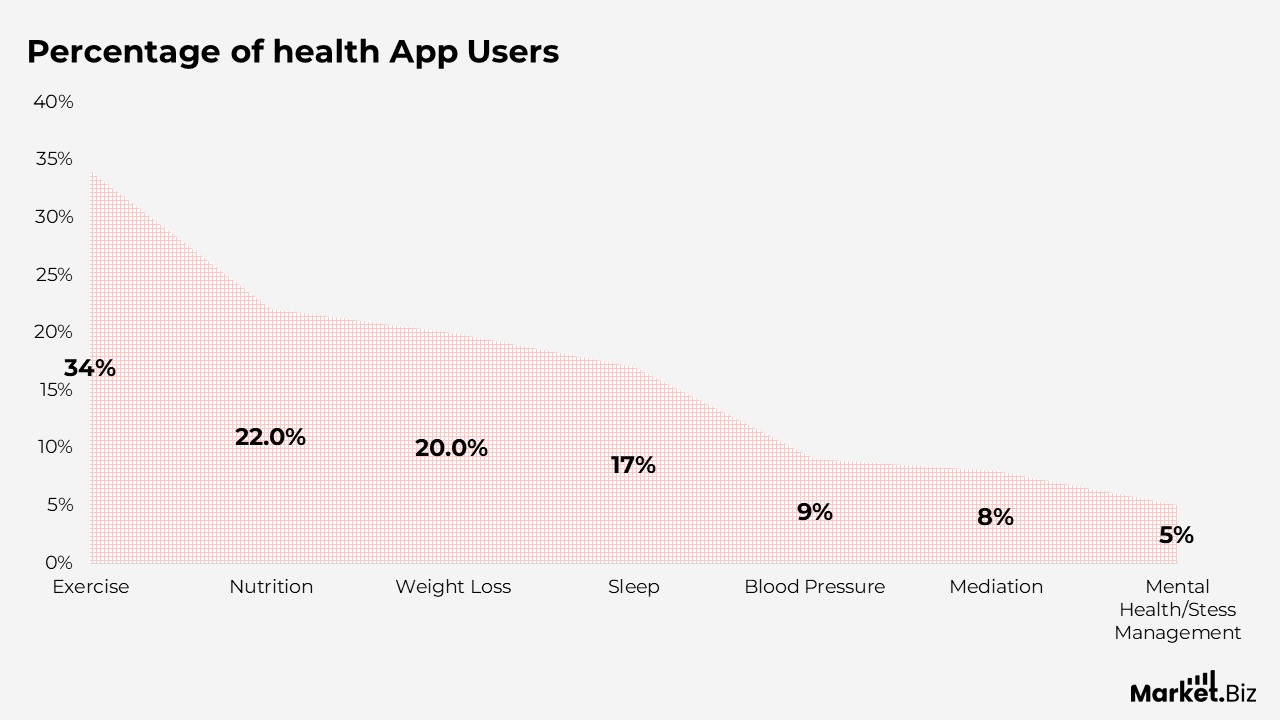

Use of mHealth App

- 34% of adults use health apps to support their exercise routines, highlighting a significant portion of users relying on technology for physical fitness tracking and motivation.

- 22% of health app users turn to these tools for nutrition, demonstrating that many individuals are using apps to monitor their diet and improve eating habits.

- 20% utilize health apps for weight loss, indicating the popularity of digital solutions in managing and achieving weight management goals.

- 17% of users rely on apps to improve their sleep, showing that a notable segment uses these tools to track and enhance sleep patterns.

- 9% use health apps to monitor blood pressure, underscoring the role of mHealth in tracking vital health metrics, particularly for those managing cardiovascular health.

- 8% engage with apps for meditation, reflecting the growing trend of using digital tools for mental wellness and stress relief.

- 5% of users turn to health apps for managing chronic mental illnesses or stress, showcasing how these apps are becoming increasingly important for mental health support.

(Source: National Poll on Healthy Aging, Vicert Inc, Business of Apps)

Health App Usage for Type 2 Diabetes Management

- 17% of older adults reported having type 2 diabetes, with 39% of them stating they have ever used a mobile health app.

- Among health app users with type 2 diabetes, 28% use the app to track their blood sugar, while 45% expressed interest in using an app for this purpose.

- 14% of users track their diabetes medication through health apps, and 45% showed interest in doing so in the future.

- Some health apps for type 2 diabetes are compatible with continuous glucose monitors (CGMs), small patches worn on the skin to measure blood sugar continuously.

- Among those with type 2 diabetes, 11% currently use a CGM, while 68% have heard of CGMs but have never used them, and 18% are unfamiliar with CGMs.

- Of those with diabetes not using a CGM, 56% expressed interest in trying one.

(Source: National Poll on Healthy Aging)

Demographics of mHealth Apps

By Age

mHealth technologies are widely available, and people’s usage varies significantly across different populations.

- Among older adults aged 50-80, 3 in 10 reported using at least one health app, while 16% had used them in the past. However, 56% stated they have not yet adopted this technology.

- In 2022, the global number of smartphone users reached 6.64 billion, meaning approximately 83% of the population owns a smartphone.

- 77% of young adults aged 18-29 used their smartphones to research health conditions, and 84 million people in the U.S. utilized healthcare apps, equating to about 30% of adult smartphone users relying on these tools for health information.

- People aged 18-34 are three times more likely to use fitness trackers than those aged 55 and older, with 28% of younger adults using them versus only 10% of older adults.

- In France, 25-39-year-olds actively used smartphones to download health apps, while 44% of those aged 40-59 also adopted them. Notably, even 20% of individuals in the 60-69 age group downloaded mHealth apps.

| Smartphone Owners | Age | Downloaded Any App | Downloaded Health App | Used App | Used Health App | Used App Last 30 Days | Used Health Apps Last 30 Days |

|---|---|---|---|---|---|---|---|

| 32% | % age <35 | 33% | 34% | 33% | 35% | 33% | 32% |

| 36% | % age 35-55 | 36% | 36% | 36% | 35% | 35% | 36% |

| 32% | % age 55+ | 31% | 30% | 31% | 30% | 32% | 32% |

(Source: Rock Health, Inc., Vicert Inc, Statista)

By Race

- 16% of Asians in the U.S. regularly use mHealth apps, highlighting a comparatively lower adoption rate within this ethnic group.

- 23% of African Americans consistently rely on mHealth apps, demonstrating higher engagement with health technologies in this demographic.

- 19% of Hispanic Americans regularly use mHealth apps, reflecting moderate acceptance and use of digital health solutions.

- 20% of Caucasians in the U.S. regularly engage with mHealth apps, with usage rates aligning closely with those of Hispanic Americans.

- 8% chose not to disclose their usage of mHealth apps, indicating that a small portion of individuals preferred to keep their engagement with these tools private.

(Source: Vicert Inc)

Health App Downloads by Smartphone OS

- 54% of Apple/iOS users have downloaded health apps, reflecting the strong adoption of digital health tools within the Apple ecosystem.

- 36% of Android users have also downloaded health apps, showing significant engagement with mobile health solutions on Android devices.

- More than 55% of Apple users actively use health apps, indicating a higher level of engagement and regular use among iOS users.

- 47% of Android users regularly utilize health apps, demonstrating a solid active usage rate within the Android user base.

(Source: Rock Health, Inc.)

Number of mHealth Apps on Google Play Store

Statistics on the Number of mHealth Apps in the Google Play Store from Q1 2015 to Q3 2024:

- In the latest period, the Google Play Store offered 36,260 healthcare and medical apps, showing a slight decrease compared to the previous quarter.

- Between the beginning of 2020 and the end of 2021, the number of health apps available for Android users on the Google Play Store experienced significant growth, surpassing 65,300 in Q4 2021.

(Source: Statista)

mHealth App Challenges

- 63% of the challenges stem from the lack of clear rules and guidelines to ensure the safety of mHealth apps.

- 56% of the challenges arise due to insufficient knowledge about the technology involved in mHealth apps.

- 19% of the challenges occur because key stakeholders are not involved in developing mHealth apps.

- 13% of challenges are related to the lack of resources to create secure mHealth apps.

- 42% of people globally are unsure how to use mHealth apps effectively.

- 50% of doctors hesitate to purchase mHealth apps due to patient privacy and security concerns.

- 91% of mHealth apps fail to meet safety standards during testing.

- 71% of all apps have at least one significant security vulnerability.

- 28% of apps on iPhones risk having their encryption key, which safeguards data, stolen.

- 34% of apps on Android phones are vulnerable to having their encryption broken.

- 83% of major security threats can be prevented by incorporating protective measures directly within the app.

(Source: National Institute of Health)

Trends Statistics in mHealth Apps

- Personalized Telehealth & Remote Monitoring

- 5G-Enabled Healthcare Apps

- Voice-activated and Chatbot Assistance in Healthcare Mobile Apps

- Healthcare Gamification for Patient Engagement

- Geofencing for Location-based Healthcare Services

- Digital Therapeutics (DTx) and Mental Health Apps

- Cloud-Based EHR & EMR Mobile Access

(Source: TATEEDA GLOBAL)

Government Initiatives

- In May 2023, the National Health Authority (NHA), as part of its flagship Ayushman Bharat Digital Mission (ABDM), made significant strides in expanding the digital healthcare delivery ecosystem. Over 100 health programs and applications were successfully integrated with ABDM.

- These include prominent initiatives such aseSushrut, eSanjeevani 2.0, A-HMIS (Ministry of Ayush), ANM Andhra Pradesh Health EHR, ESIC, Haryana e-Upchaar, West Bengal Integrated HMIS, along with 33 private sector health apps from innovative developers.

Top mHealth Apps Statistics

mHealth apps are becoming increasingly popular across both older and younger generations. Of the 100,000 mobile health apps available worldwide, 85% are designed for wellness, while 15% focus on medical applications.

MyFitnessPal

- MyFitnessPal is among the top weight loss and fitness apps, supporting nearly 1 million members yearly in achieving their nutrition and fitness objectives.

- As the most widely used health app, it assists users in tracking their nutrition, exercise, and weight loss progress.

- In 2023, MyFitnessPal generated $310 million in revenue, marking a remarkable 67% growth compared to the previous year.

- With 200 million users, it is the most popular health and fitness app globally.

Headspace

- This app offers guided meditation and mindfulness exercises to alleviate stress and anxiety.

- With more than 2.8 million subscribers and over 80 million downloads, Headspace has become a leading app in the wellness space.

- In 2023, Headspace reported $195 million in revenue, reflecting its growing influence in the mental health and wellness industry.

Fitbit

- The app provides guided meditation and mindfulness techniques to reduce stress and anxiety.

- With a user base of over 2.8 million subscribers and 80 million downloads, Headspace has established itself as a top contender in the wellness industry.

- In 2023, Headspace achieved $195 million in revenue, highlighting its expanding impact within the mental health and wellness sector.

Calm

- In 2023, Calm achieved $300 million in revenue.

- The app boasts a subscriber base of over 4.5 million users.

- During its latest funding round, Calm was valued at $2 billion.

- With over 100 million downloads, Calm has reached a vast global audience.

Strava

- Strava earned $275 million in revenue in 2023.

- In 2022, Strava had 1 million active users, with 2 million new users joining the platform monthly.

- Over 2 billion activities were recorded on Strava in 2021.

- By the end of 2022, Strava had amassed a user base of 95 million.

- Strava saw significant growth in 2020, particularly in Europe, the Middle East, and Africa.

Recent Developments

New Product Launches

- In July 2024, the Mobile Health platform, a digital health, wellness, and virtual care SaaS provider, launched a virtual care solution targeting major chronic health conditions such as diabetes, hypertension, musculoskeletal disorders, weight management, depression, anxiety, and prenatal care.

- In April 2024, the Indian government introduced the myCGHS app on iOS to improve access to electronic health records and patient information.

- In November 2022, DocGo, a U.S.-based mobile medical services and transportation company, integrated its first app with Epic to provide on-demand access to mobile health services.

Acquisitions

- In February 2024, Aptar Digital Health, a leader in digital health solutions, acquired Healint, a digital health company known for its virtual clinical studies, real-world evidence, patient registry platform, and mobile apps like Migraine Buddy and Clarrio. This acquisition enhances Aptar’s portfolio in neurology and strengthens its global presence in digital health deployment.

- In December 2024, Bayer AG, the German multinational pharmaceutical and biotechnology company, acquired HiDoc Technologies to begin commercializing the digital health app Cara Care. Cara Care is the prescribed digital health app for treating irritable bowel syndrome (IBS), offering a novel and holistic therapeutic approach for IBS patients.

Funding Rounds

- Red Rover Health raised $4 million in funding from NewShore Partners to expand its healthcare app store platform.

- CareLink secured $20 million in seed funding from Angel Investors Group ABC to accelerate user acquisition and invest in AI-driven predictive analytics for personalized health recommendations, aiming for a 50% increase in monthly active users.

- HealthApp raised $40 million in Series B funding, led by Venture Capital Firm XYZ, to enhance its mHealth platform, expand into new markets, and double user engagement within the next two years.

Consumer Trends

- Mental health and mindfulness apps saw substantial growth, with meditation and stress-relief apps experiencing a 40% increase in user engagement, highlighting a growing focus on mental well-being.

- The rising adoption of wearables and connected devices fueled the demand for mHealth apps, leading to a 35% increase in downloads compared to the previous year.

Regulatory Landscape

- Regulatory authorities established guidelines to safeguard data privacy and security in mHealth apps, enhancing consumer trust and confidence in digital health solutions while ensuring compliance with healthcare regulations.

Conclusion

mHealth Apps Statistics: mHealth apps are revolutionizing healthcare by enhancing accessibility, patient engagement, and overall wellness. The increasing adoption rates highlight the growing demand for digital health solutions, particularly in telemedicine and AI-powered diagnostics.

However, data privacy, regulatory issues, and user retention remain. Overcoming these challenges through improved security and user-centered design is essential. As AI and big data continue to evolve, collaboration between developers, healthcare providers, and policymakers will be crucial in unlocking the full potential of mHealth.

FAQ’s

mHealth apps are mobile applications designed for smartphones and tablets, offering healthcare-related services and information. These apps are intended to provide users with essential health and wellness resources, enabling easy access to various health management tools. Common features of mHealth apps include fitness tracking, medication reminders, and health monitoring.

mHealth apps offer several advantages, such as enabling remote health monitoring, providing convenient access to healthcare services and information, enhancing medication adherence, and promoting healthier lifestyle choices.

mHealth apps have become integral to daily life, as they are easily accessible on smartphones, tablets, and other devices. In healthcare, these apps offer a practical solution to many challenges. With the ability to track health metrics and fitness goals anytime and from anywhere, mHealth apps help individuals stay on top of their well-being and reach their fitness objectives more effectively.

MyFitnessPal, Headspace, and Calm are leading apps that help millions of users track their fitness, mental health, and wellness objectives.