Introduction

Robotic Surgery Statistics: Robotic surgery revolutionizes modern healthcare by providing precise, minimally invasive procedures that improve patient outcomes and accelerate recovery. The adoption of cutting-edge robotic technologies in operating rooms is reshaping surgical practices across the globe. Fueled by increasing investments in advanced surgical robots and a growing need for highly accurate procedures, the robotic surgery market is experiencing rapid expansion.

The market is expected to grow substantially over the next decade, driven by factors such as an aging population, the rising incidence of chronic diseases, and continuous advancements in surgical technology. This shift toward robotic-assisted surgeries is not only enhancing patient care but also helping to address challenges like the shortage of skilled surgeons, particularly in regions with high healthcare demands. As the industry evolves, robotic surgery is set to offer improved capabilities in various medical fields, including orthopedics, neurosurgery, and cancer treatment.

Editor’s Choice

- The global number of medical robots is expected to grow significantly, rising from around 713 units in 2016 to over 2,100 units by 2025, highlighting a rapid expansion in robotic surgical technology.

- Adoption rates of robotic surgery are highest in larger teaching hospitals, with an impressive 85% adoption rate. In contrast, smaller hospitals with fewer than 200 beds have adopted robotic surgery at 42%, while larger facilities with more than 500 beds report a lower adoption rate of 15%.

- The da Vinci surgical system has seen substantial growth, generating $2.41 billion in revenue during Q4 2024, marking a 25% increase compared to the previous quarter. The company anticipates long-term revenue reaching $8.35 billion, reflecting a 17% growth trajectory.

- The volume of procedures performed using the da Vinci system surged by 18% in Q4 2024, with 2,683,000 procedures conducted throughout the year. Notably, procedures in the U.S. grew by 19%, while international usage expanded by 23%.

- In Q4 2024, Intuitive placed 493 new da Vinci surgical systems, including 174 da Vinci 5 model units. This brings the total number of placements to 1,526 systems for the year, a notable increase from 1,370 placements in 2023.

- Incorporating augmented reality (AR) and artificial intelligence (AI) in robotic systems is transforming the field of surgery. These advanced technologies enable remote surgeries and improve surgical precision, reducing complications and faster patient recovery times.

- Robotic surgery continues to gain traction due to its ability to perform minimally invasive procedures, offering significant benefits such as quicker recovery times and fewer complications. This is particularly impactful in specialties such as orthopaedics, gynecology, and urology, where precision and recovery time are crucial.

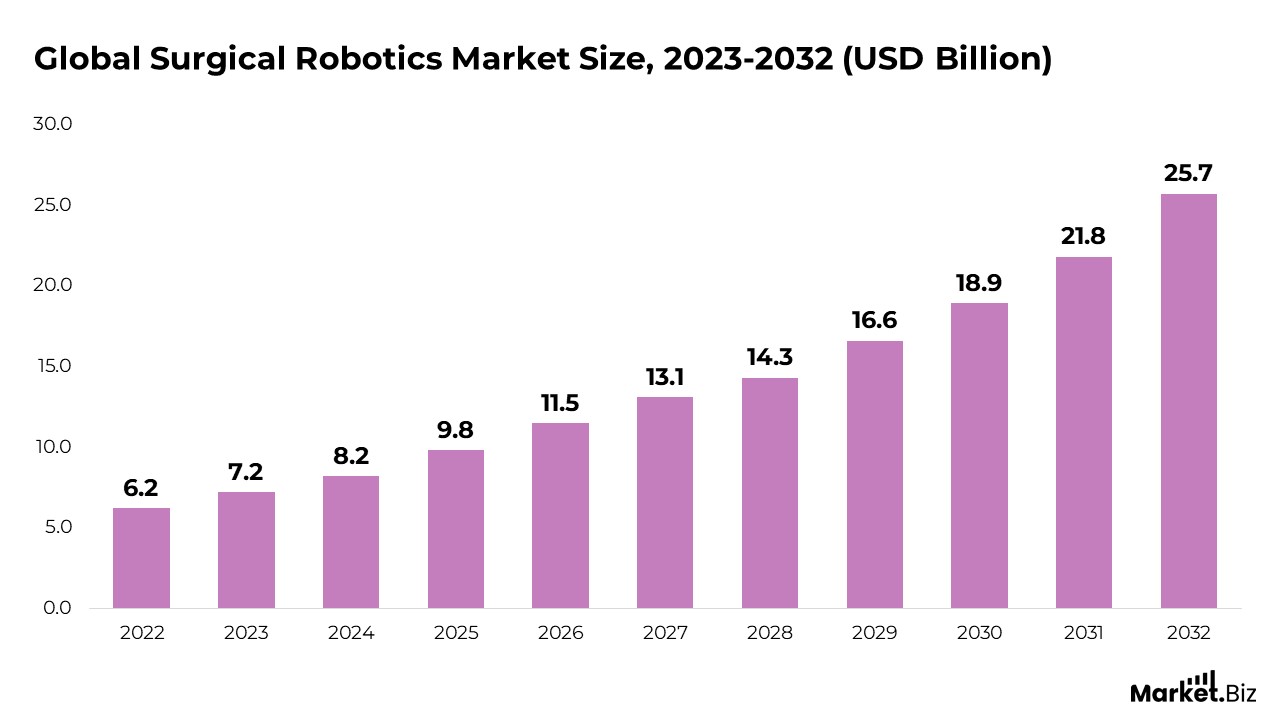

Surgical Robotics Market Size

- According to Market.us, the global robotic surgery market is projected to grow from $9.8 billion in 2025 to $25.7 billion by 2032, with a CAGR of 15.7% from 2022 to 2032, driven by increasing investments in advanced surgical technologies and a growing aging population.

- The accessory segment is the most profitable surgical robotics market, fueled by the rise in chronic conditions and an aging population. The services segment is also expected to grow due to the increasing use of robot-assisted surgeries.

- Neurosurgery is forecasted to be the most lucrative segment, with high demand for robotic neurosurgeries offering high accuracy. Additionally, robotics in cancer treatments is gaining traction.

- Hospitals are expected to dominate the market, accounting for 73% of the revenue share and experiencing strong growth due to the adoption of surgical robots.

- In 2022, North America led the market with a 51% share, driven by a shortage of surgeons and increased regional healthcare facilities.

(Source: Market.us)

Different Types of Robotic Surgery Systems

- CyberKnife

- Da Vinci Surgical System

- ROSA Robot

- Artas System

- MAKOplasty

- Versius Surgical Robotic System

- ExcelsiusGPS

What types of conditions can be addressed through robotic surgery?

- Gynecologic Surgery

- Prostate Surgery

- Kidney Surgery

- Lung Surgery

- Colorectal Surgery

- Gallbladder Surgery

- General Surgery

- Urologic Surgery

- Thoracic Surgery

- Head and Neck Surgery

- Heart Surgery

(Source: UCLA Health, Summerlin Hospital Medical Center)

Distribution of Surgical Robot Units

- The global number of surgical robots has steadily increased across various regions.

- In 2016, the total number of surgical robots was approximately 713, with a further rise observed in 2017.

- Projections indicate that by 2025, the number of surgical robots worldwide will exceed 2,100 units.

- This sharp growth underscores the growing acceptance and integration of robotic-assisted surgeries within the healthcare sector, driven by technological advancements and the increasing demand for precision in medical procedures.

Surgical Robotics Market Value by Application

- In 2023, the global surgical robotics market for gynecological procedures was valued at around 3.1 billion U.S. dollars, while the market for general surgery robotics was slightly below 3 billion U.S. dollars.

- By 2026, the market for surgical robots in gynecology is projected to exceed 4.1 billion U.S. dollars.

- This growth reflects the growing adoption of robotic systems in gynecological procedures, driven by enhanced precision, effectiveness, and improved patient outcomes.

(Source: Statista)

Surgical Procedures Conducted with Robotic Assistance

Prostatectomy

Robot-assisted laparoscopic prostatectomy is gaining popularity as a treatment for prostate cancer due to its benefits, including shorter hospital stays, decreased blood loss, and quicker recovery times.

- Approximately 85% of radical prostatectomies are currently conducted using robot-assisted techniques.

Colorectal Surgery

Robot-assisted cardiac surgery has become a key technique in procedures such as mitral valve repair, coronary artery bypass grafting, and atrial septal defect closure. Robotic technology enhances surgical precision and provides superior visualization of the surgical area.

- The most frequently performed colorectal surgeries using robotic assistance include right hemicolectomy (20%), sigmoid colectomy (11%), low anterior resection (41%), and anterior resection (10%).

- By 2020, approximately 18% of mitral valve repair surgeries were projected to incorporate robotic technology.

Hysterectomy

Robot-assisted laparoscopic hysterectomy is rapidly becoming a preferred minimally invasive option for uterine removal. Enhanced visualization and greater precision in surgical movements have contributed to its swift popularity.

- In 2023, minimally invasive surgery was employed in 65% of hysterectomy procedures, with robotic assistance in up to 43% of these cases in the U.S.

Bariatric Surgery

Robot-assisted bariatric surgery, which includes procedures such as gastric bypass and sleeve gastrectomy, has seen a surge in popularity. This approach offers significant advantages, including reduced postoperative pain and quicker recovery times.

- The ASMBS reported that nearly 280,000 metabolic and bariatric robotic procedures were performed in the U.S. in 2022.

(Source: The ASCO Post, Research Gate, National Institute of Health, ASMBS))

Industrial Robotics Application Areas

(Source: Statista)

Adoption of Robotic Surgery Methods Across Various Hospital Types

- The adoption of robotic surgery varies significantly across different types of hospitals.

- Teaching hospitals report a high adoption rate of 85%, as they often leverage robotics for medical training surgical research, and to incorporate the latest technologies in patient care.

- On the other hand, smaller hospitals with fewer than 200 beds have a considerably lower adoption rate, with only 42% utilizing robotic surgery systems. This is likely due to the high costs of robotic systems and a shortage of specialized surgeons skilled in robotic-assisted procedures.

- Larger hospitals with more than 500 beds exhibit an even lower implementation rate of just 15%. This may initially seem surprising, but these hospitals often face high volumes of emergency cases, which can overshadow the use of robotic surgery. Additionally, these institutions may have multiple surgical departments, some of which may not have integrated robotic systems into their practices.

(Source: Statista, Electro IQ)

Da Vinci Surgical System

The Vinci operating system, established by Intuitive, is an extensively utilized robotic surgery platform designed to support surgeons conducting minimally invasive procedures.

- There are currently more than 1,700 Vinci Systems connected in hospitals worldwide.

- More than 775,000 sufferers globally have experienced da Vinci Surgical System procedures.

- In the U.S., roughly 3 out of 4 prostate cancer operations are performed using da Vinci technology, making it the most popular treatment option for men with prostate cancer.

- Eighty-six per cent of urology internship plans are in the United States. Incorporate Vinci Systems into their training. At the same time, all forty-two gynecologic oncology companionship programs have adopted Vinci technology as part of their curriculum.

- Robotic processes are most commonly performed in urology, with over 40,000 procedures annually, accounting for 45.5% of the total.

- Around 40 hospitals perform at least three hundred urological robotic operations each year.

- Seven hospitals are conducting over 1,000 robotic procedures annually.

- Nine hospitals perform between 600 and 1,000 robotic procedures each year.

- Thirteen hospitals conduct between 400 and 600 robotic surgeries annually.

- Eleven hospitals perform between 300 and 400 robotic operation techniques each year.

(Source: UC Health, ScienceDirect, Market.us, Electro IQ )

Complications and Safety in Robotic Surgery

- The conversion rate from robotic to open operation remains low, typically from 0.8% to five %,with variations depending on the procedure and the surgeon’s level of expertise.

- Research indicates that surgical spot contagions in robotic surgeries are relatively low, generally between 0.8% and 2.5%.

- Main complications, such as vascular or bowel injuries, are infrequent, with occurrence rates typically under 1%.

- Complications for robotic surgeries range from four to nine per cent, with severe problems occurring in fewer than five per cent of cases.

- While difficulty rates differ based on the procedure, major complications generally remain below ten per cent.

(Source: ScienceDirect, National Institute of Health, Market.us)

The Future Outlook and Growth of Surgical Robotics

- Significant advancements in robotic-aided medical technologies have been made since the introduction of robotic interventions in the early 1980s.

- Computerized surgical procedures represent one of the most transformative changes in surgery over the past four decades.

- Intuitive Surgical has reportedly facilitated over 12 million surgeries using its da Vinci robotic systems.

- However, this figure is only a small fraction of the potential, as the increasing use of robotic systems across various procedures highlights robotic surgery’s growing success and potential.

- The widespread availability of robotic systems across various surgical specialities has delivered substantial benefits for patients, surgeons, and healthcare institutions.

- For patients, robotic surgeries typically result in minimally invasive procedures, leading to faster recovery times and improved healing.

- A recent report by Bain & Company revealed that 78% of U.S. surgeons expressed interest in incorporating robotic systems into their surgeries.

- Despite high robotic adoption in fields like total hip and knee replacement, many procedures in these areas still aren’t performed using robotics, indicating a major opportunity for broader technology adoption.

- In the future, the focus of surgical robotics advancements will shift away from merely increasing market share, instead focusing on addressing gaps and uncovering new opportunities for technological growth and integration.

(Source: Intuitive Surgical, Bain & Company, National Institute of Health)

Recent Developments

New Product Launches and Approvals

- In August 2024, DePuy Synthes, a Johnson & Johnson MedTech division, launched the VELYS Active Robotic-Assisted System. This system is designed to improve the planning and execution of spinal fusion surgeries, targeting the spine’s cervical, thoracolumbar, and sacroiliac regions.

- In March 2024, Intuitive, a leading innovator in minimally invasive technologies and robotic-assisted surgery, received 510(k) clearance from the U.S. Food and Drug Administration for its da Vinci 5 multiport robotic system. The system will drive the next wave of advancements in robotic-assisted surgical procedures…

Mergers and Acquisitions

- In March 2025, Distalmotion, a medical technology company, acquired its DEXTER Robotic Surgery System from the Northtowns Ambulatory Surgery Center, an ambulatory surgery center in the U.S., to enable more surgeons to enhance their capabilities and deliver high-quality, minimally invasive care at a cost-effective ambulatory price point.

- In August 2024, Asensus Surgical, Inc. merged with the KARL STORZ Group to accelerate developing and delivering innovative robotic and digital surgical solutions. This partnership aimed to advance precise, safer, and more predictable surgical outcomes, benefiting patients and surgeons worldwide.

Fundings Rounds

- In April 2025, CMR Surgical, a leading surgical robotics company, secured USD 200 million in funding to drive the global commercial expansion of its Versius Surgical Robotic System, with a primary focus on its launch in the United States. The funds will also support continued innovation and product development, including introducing the enhanced Versius Plus system.

- In January 2025, Cornerstone Robotics raised USD 70 million to accelerate its commercialization efforts. The funding will be used to develop new surgical robotic products, conduct clinical trials, obtain regulatory approvals, and foster the worldwide adoption of advanced robotic surgical solutions.

Consumer Trends

- The growing demand for minimally invasive operation has significantly driven the acceptance of robotic surgical systems, with the number of operations implemented using robotic help growing by 30% year-over-year.

- There is a growing patient preference for surgical procedures that involve smaller incisions, reduced pain, and quicker recovery times. This shift towards minimally invasive options is significantly driving the adoption of robotic-assisted surgeries, which cater to these patients demands for less invasive treatment methods.

Regulatory Environment

- Regulatory bodies have established comprehensive guidelines to ensure the performance and safety of robotic surgery, safeguard patient welfare, and ensure compliance with quality standards in robotic-aided procedures.

Research and Development Investment

- Medical device manufacturers and technology companies have committed substantial resources to the research and development of robotic surgery technologies, with global investments estimated at $5 billion focused on advancing robotic surgery and expanding market reach.

Conclusion

Robotic Surgery Statistics: The robotic surgery market is set for substantial growth, fueled by technological innovations, an aging population, and the rising demand for precise, minimally invasive procedures. As healthcare systems across the globe integrate robotic technologies, the benefits of improved patient outcomes, shorter recovery times, and enhanced surgical precision are becoming more apparent.

The market is expected to expand rapidly in the coming years. With key areas like neurosurgery, orthopedics, and cancer treatment leading the charge. Moreover, adopting robotic-assisted surgeries is helping to improve the shortage of skilled surgeons, making healthcare more accessible and efficient. With continued advancements and investments, robotic surgery is poised to reshape the surgical field and elevate the overall quality of patient care worldwide.

FAQ’s

Robotic surgery is predominantly utilized in gynecology, urology, and orthopedics. Additionally, there is growing adoption in cardiac surgery, general surgery, and spinal surgery. Urology takes the lead, particularly for procedures such as prostatectomy.

The global adoption of robotic surgery is growing rapidly. For instance, the number of robotic surgeries has increased by 30% annually, indicating rising confidence in robotic systems to improve surgical precision, shorten recovery periods, and reduce complications.

Robotic surgery has notably enhanced patient outcomes, contributing to shorter hospital stays, less blood loss, faster recovery, and fewer complications. These benefits have fueled its popularity, especially for procedures that once required larger incisions.

While robotic surgeries generally come with higher initial costs due to the robotic systems’ price and maintenance, the long-term savings often outweigh these expenses. Reduced complication rates, shorter recovery times, and fewer hospital readmissions can lead to overall cost reductions, making the higher upfront investment worthwhile.

The da Vinci Surgical System remains the most widely utilized robotic surgery platform worldwide. Other notable systems include the RAS systems from Medtronic, the Versius system by CMR Surgical, and various robotic platforms developed by companies such as Intuitive Surgical and Stryker.