Introduction

Nursing Home Care Statistics: Nursing home care is an essential service that provides long-term medical and personal assistance to elderly individuals who cannot live independently due to physical or cognitive impairments. As the global population ages, there is an increasing demand for skilled nursing services within long-term care facilities, such as nursing homes. This demographic shift places substantial pressure on healthcare systems and the infrastructure supporting long-term care.

These facilities face numerous challenges, including staff shortages, escalating operational costs, and the continual need to enhance the quality of care provided. Nonetheless, government programs like Medicaid remain a critical funding source, ensuring that individuals who need assistance have access to necessary care.

These statistics offer an in-depth analysis of the nursing home care sector, highlighting the key factors influencing the market. It explores the financial landscape, regulatory developments, and demographic changes that shape the industry. The aim is to provide a comprehensive understanding of the current state of nursing home care, delivering valuable insights for industry professionals and stakeholders.

Editor’s Choice

- According to recent data from the CDC, approximately 4.5% of adults aged 65 and older in the United States currently reside in nursing homes or comparable long-term care facilities. While this represents a relatively small portion of the senior population, it reflects a group with significant medical and daily living support needs.

- The average age of individuals living in nursing homes is around 79 years, suggesting that most residents enter these facilities during the later stages of aging when health-related dependencies become more complex.

- There is a notable gender imbalance among nursing home residents, with women making up roughly 70% of the population. This is consistent with broader demographic patterns, as women tend to live longer than men and are more likely to require institutional care in the absence of a spouse or informal caregiver.

- The United States was home to approximately 15,600 nursing homes in 2018, forming a foundational part of the nation’s eldercare infrastructure. Despite this extensive network, facilities face ongoing quality, staffing, and modernization pressures.

- Currently, around 1.4 million individuals reside in U.S. nursing homes, highlighting the scale of reliance on these services, especially among seniors with high levels of physical or cognitive impairment.

- It is projected that 7 in 10 adults aged 65 will need some form of long-term care during their lifetime. This underscores the increasing importance of planning for care needs well before such services are required, both at the individual and policy levels.

- Demographic trends suggest that by 2050, as many as 30 million Americans may require long-term care services. This projection points to a looming demand surge, driven by longer lifespans and the aging Baby Boomer generation, which will significantly stress existing care models and funding structures..

(Source: USA Facts, Centers for Disease Control and Prevention, National Institutes of Health)

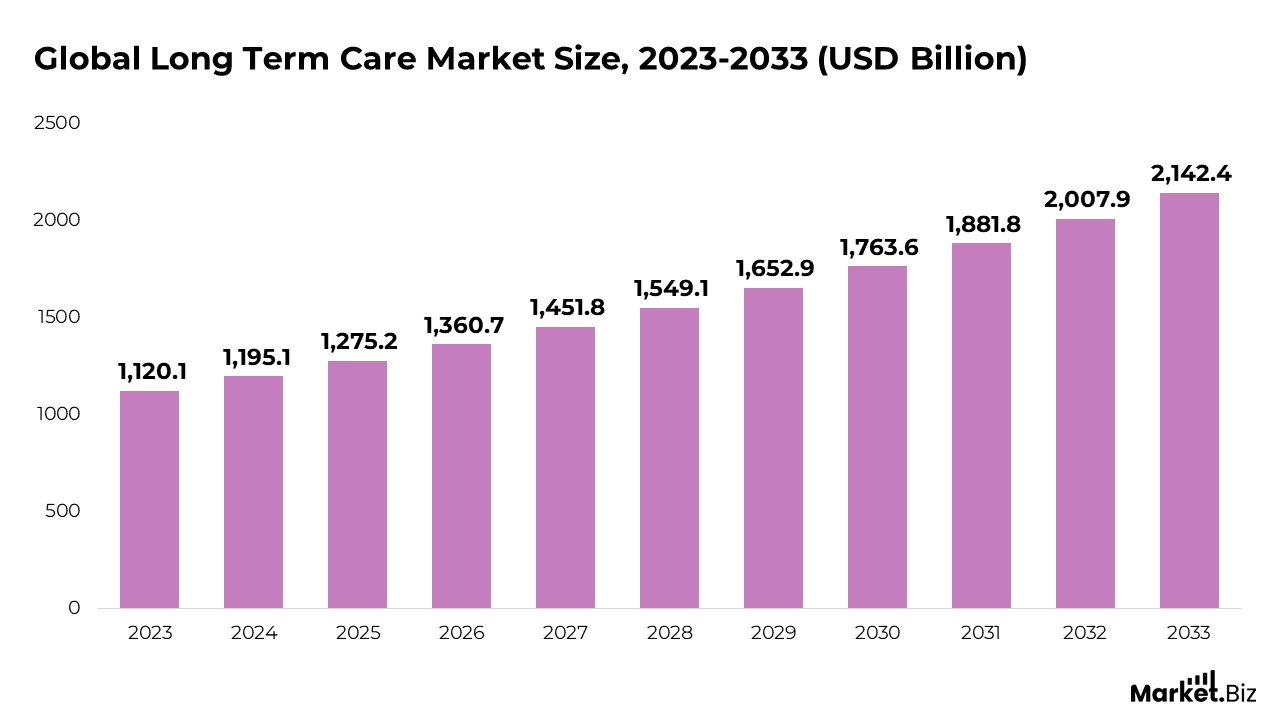

Global Long-Term Care Market Size

- As per Market.us, the global long-term care market is anticipated to expand from $1,275.2 billion in 2025 to $2,007.9 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.7% from 2023 to 2033.

- The rising aging population primarily drives the growth of the nursing home care market, the increasing prevalence of chronic diseases, greater awareness of elder care needs, and advancements in healthcare.

- In 2023, the nursing care segment led the market, capturing a share of 32.4%, driven by the rising preference for elderly care and strong demand from developing nations. As the geriatric population increases and chronic conditions like heart disease, Alzheimer’s, and cancer become more widespread, the demand for nursing care continues to grow.

- The public sector accounted for a significant share of 46.1%, fueled by substantial public spending in the U.S. and European countries. Government initiatives like Medicare and Medicaid have further supported the expansion of this segment.

- North America held the largest revenue share of 43.7%, supported by factors such as the growing elderly population, favorable government policies, and expanded insurance coverage.

(Source: Market.us)

Nursing Home Care Statistics

- In 2022, the global long-term care industry was valued at approximately US$1,100.7 billion, with forecasts indicating a potential rise to US$2,168.1 billion by 2032. This expansion reflects a projected compound annual growth rate (CAGR) of 7.2% between 2023 and 2032, driven by aging demographics, chronic disease prevalence, and increased life expectancy across developed and emerging economies.

- After a decline observed between 2010 and 2020, where the U.S. nursing home resident population dropped from 1.39 million to 1.29 million—a modest rebound occurred in 2023, bringing the number back up to approximately 1.4 million residents. This resurgence may be attributed to the gradual recovery of facility occupancy rates following the pandemic’s impact.

- As of 2022, about 1.3 million individuals were receiving care in nearly 15,000 certified nursing homes across the United States, emphasizing the extensive reach and foundational role of institutional care settings in the national long-term care ecosystem.

- It is estimated that seven out of every ten adults will need some form of long-term care services during their lifetime. This high likelihood underscores the urgency for public health systems and individuals to prepare for sustained care needs, particularly as the senior population grows.

- Globally, Denmark, Norway, the Netherlands, and Sweden are among the top spenders on long-term care. These nations allocate significant portions of their healthcare budgets toward eldercare services, often integrating robust public funding models and home-based care strategies, which can serve as benchmarks for aging policy frameworks in other regions..

(Source: Market.us, Zippa, Inc., National Institute of Health, S2S Global, Genworth, Organisation for Economic Co-operation and Development)

Demographics of Nursing Home Care

Age

- A detailed examination of the age distribution within U.S. nursing homes indicates that adults aged 85 and above represent the largest proportion of residents, accounting for approximately 38.6%. This figure emphasizes the strong association between advanced age and the need for full-time institutional care, often driven by age-related physical and cognitive impairments.

- Individuals aged 75 to 84 comprise about 26.7% of the nursing home population. Admissions in this group are frequently linked to complications from chronic illnesses such as heart disease or diabetes, which may necessitate sustained medical supervision and support.

- Roughly 18.2% of residents are between the ages of 65 and 74, a segment often facing early disability, reduced mobility, or lacking sufficient caregiving support at home, prompting a transition to facility-based care.

- Notably, 16.5% of nursing home residents are under the age of 65, illustrating that these institutions also serve younger adults. This demographic typically includes individuals with long-term disabilities, neurological disorders, or serious psychiatric conditions requiring continuous care.

- This age-based breakdown highlights the complex nature of long-term care, where various health challenges, not just aging, drive demand for services. The presence of a broad age spectrum among residents points to the need for personalized, multidisciplinary care models that address both medical and social dimensions of well-being..

Gender

- Roughly two-thirds of nursing home residents are women, representing approximately 67% of the population.

- Men account for the remaining 33%, reflecting a significant gender gap in long-term care facilities.

- This disparity is primarily driven by greater female longevity, as women tend to outlive men by several years, increasing their likelihood of requiring institutional care in old age.

- Older women are also more likely to be widowed or living alone, making them more dependent on formal care settings due to the absence of spousal or family caregivers.

- The higher female presence, particularly in the 85+ age group, indicates a strong correlation between gender, age, and care dependency in the long-term care landscape..

Race

- The vast majority of nursing home residents, about 89%, identify as non-Hispanic white, indicating a predominant representation of this demographic group in long-term care facilities.

- Approximately 6% of residents are non-Hispanic Black, reflecting disparities that differences may influence access to care, socioeconomic factors, and cultural preferences for aging in place.

- Residents from other racial or ethnic backgrounds make up around 5% of the nursing home population, highlighting a smaller but diverse segment within these care settings.

- These figures underscore the racial and ethnic composition of nursing homes, which, through broader demographic trends, regional population distributions, and varying patterns of healthcare utilization among minority communities, can shape.

(Source: SingleCare Administrators, National Center for Assisted Living, American Health Care Association)

Health Implications of Long-Term Care Services

- High blood pressure is the most prevalent condition, affecting approximately 55% of long-term care residents, reflecting its widespread impact among older adults and its role as a major risk factor for other chronic diseases.

- Alzheimer’s disease and other forms of dementia are present in about 34% of residents, highlighting the significant cognitive care needs within these facilities.

- Depression affects nearly 27% of individuals in long-term care settings, emphasizing the importance of mental health support alongside physical healthcare.

- Arthritis, a common cause of chronic pain and mobility issues, impacts roughly 20% of residents, often complicating daily activities and quality of life.

- Diabetes also affects around 20% of this population, requiring careful management to prevent complications such as infections and cardiovascular problems.

- Heart disease is diagnosed in about 17% of long-term care residents, underscoring the need for continuous cardiac monitoring and specialized care protocols.

- Osteoporosis, present in 12% of residents, contributes to increased fracture risk and mobility challenges, necessitating preventive measures and rehabilitation efforts.

- Chronic obstructive pulmonary disease (COPD) and related respiratory conditions affect nearly 11% of residents, often requiring supplemental oxygen and respiratory therapy.

- Stroke survivors make up about 10% of the long-term care population, many of whom require extensive rehabilitation and assistance with daily functioning.

(Source: SingleCare Administrators, National Center for Assisted Living, American Health Care Association)

Nursing Home Centers

- The United States has approximately 15,000 nursing homes, forming a substantial network of facilities catering to long-term care needs nationwide.

- These nursing homes offer close to 1.7 million licensed beds, indicating significant capacity to serve an aging population with varying care requirements.

- The average occupancy rate is about 75%, reflecting ongoing demand while suggesting some availability to accommodate new residents or seasonal fluctuations.

- Approximately 70% of nursing homes are owned and operated by for-profit entities, influencing operational priorities, resource investment, and care models across the sector.

- An estimated 1.3 million individuals reside in nursing homes, highlighting these institutions’ critical role in providing residential healthcare services.

- Staffing patterns show an average of 0.86 registered nurses (RNs) per resident per day, along with 2.21 certified nursing assistants (CNAs) per resident daily, underscoring the reliance on a mix of skilled and supportive caregiving personnel to meet resident needs effectively.

| Year | Newly Opened Nursing Homes | Total Beds Available (millions) | Percentage on Waiting Lists |

|---|---|---|---|

| 2020 | 73 | 1.60 | 57% |

| 2021 | 71 | 1.55 | 57% |

| 2022 | 55 | 1.54 | 57% |

| 2023 | 37 | 1.50 | 57% |

(Source: National Institute of Health, Market.us, Rosewood Nursing)

Incidence of Falls in Nursing Home Residents

- Each year, nearly 1,800 elderly individuals residing in nursing homes succumb to injuries caused by falls, underscoring the significant risk falls pose within these care environments.

- In 2022, the nursing home population aged 65 and older was estimated at 1.5 million, highlighting the sizable demographic vulnerable to fall-related incidents.

- Projections indicate that by 2030, this number could nearly double to around 3 million older adults living in nursing homes, potentially increasing the absolute number of fall-related injuries and fatalities.

- Although nursing home residents make up only about 5% of the population aged 65 and above, they account for roughly 20% of all fall-related deaths among this age group, illustrating their heightened vulnerability.

- A nursing home with 100 beds typically reports between 100 and 200 falls annually, indicating that falls are a frequent and recurring challenge in these settings.

- On average, residents experience approximately 2.6 falls per person yearly, reflecting this safety concern’s persistent nature.

- About 35% of fall injuries occur among residents who are non-ambulatory, revealing that even individuals with limited mobility remain at significant risk.

- Falls lead to serious injuries in 10% to 20% of cases, resulting in prolonged hospital stays, decreased independence, and higher healthcare costs.

- Fractures, a severe consequence of falls, are reported in approximately 2% to 6% of incidents, contributing to increased morbidity among nursing home residents.

- Between 16% and 27% of falls are attributed to environmental hazards within the nursing facility, highlighting the critical importance of ongoing safety audits and preventive interventions to reduce risks.

(Source: Centers for Disease Control and Prevention)

Challenges in Nursing Homes

- Shortages in staffing and high employee turnover adversely affect the quality of resident care.

- Maintaining consistent patient safety while addressing complex health conditions

- Budget limitations restrict investment in personnel, medical equipment, and facility improvements.

- Navigating rigorous federal and state regulatory requirements that demand considerable administrative resources

- Caring for residents with multiple chronic illnesses and cognitive disorders such as dementia

- Tackling mental health challenges and reducing feelings of social isolation among residents

- Implementing effective infection prevention and control measures in shared living spaces

- Ensuring the physical environment is secure to minimize risks of falls and accidents

- Managing family communication effectively while respecting residents’ independence and care preferences

- Overcoming barriers to adopting new healthcare technologies due to financial costs and staff training needs

(Source: Justice in Aging)

Recent Developments

New Product Launches

- In November 2024, CoreCare introduced CoreCare Admit, a tool for preadmission screening and Resident Review (PASRR) tracking in skilled nursing facilities.

- SeniorCare introduced a mobile app designed to enhance communication with families and provide updates on residents’ well-being, offering peace of mind to relatives and improving interaction with nursing home staff. The app aims to be adopted by 1,000 families within the next six months.

Acquisitions and Mergers

- In April 2025, Titan Nurse Staffing, LLC, merged with Titan Medical Group, LLC, to optimize healthcare staffing services.

- In December 2024, CareTrust REIT, Inc. acquired the Midwest Skilled Nursing Portfolio for nearly $97 million to enhance operational efficiency and clinical performance at these facilities..

Fundings Rounds

- In February 2025, the Department of Health secured €10 million in funding to assist private and voluntary nursing homes in enhancing their facilities to meet residents’ needs.

- In July 2024, the Moving Forward Nursing Home Quality Coalition was awarded a $1.69 million grant to strengthen nursing home staff support and elevate the quality of life for residents.

Initiatives to Enhance Care Quality

- Nursing home operators have introduced quality improvement programs to boost resident care outcomes, focusing on minimizing medication errors, preventing falls, and strengthening infection control protocols.

- Staff training programs in nursing homes have prioritized person-centred care techniques and cultural competence, ensuring that caregivers can better address the diverse needs of the resident population.

Government Funding and Regulations

- Regulatory bodies have implemented more stringent guidelines for nursing home operations, focusing on staffing requirements, infection control measures, and mandatory quality reporting to enhance transparency and ensure accountability in care delivery.

- Government funding for nursing home care has increased, with additional resources directed towards Medicaid reimbursements, facility improvements, and initiatives to develop and strengthen the workforce..

Adoption of Technology in Nursing Homes

- Nursing homes have increasingly incorporated technology solutions to improve resident care and facility management. This includes using telemedicine platforms, electronic health records (EHRs), and assistive devices designed to enhance mobility and promote independence for residents.

Conclusion

Nursing home care plays a crucial role in the healthcare system, especially as the global population ages and the prevalence of chronic health conditions increases. The rising demand for nursing home services is driven by various factors, such as the expanding elderly population, heightened awareness of elder care needs, and advancements in healthcare.

The nursing care segment remains dominant, particularly in developed regions like North America and Europe, thanks to strong government support through Medicare and Medicaid programs and growing public and private investments in elderly care.

Although nursing homes face challenges, including staffing shortages and rising operational costs, the sector is set for continued expansion. The increasing need for professional care, combined with a focus on improving care quality and facility standards, is expected to shape the industry’s future. As governments, healthcare providers, and families place greater importance on the well-being of the aging population, nursing homes will continue to be a critical element in the long-term care system.

FAQ’s

The rising demand for nursing home care is mainly due to the aging population, a higher prevalence of chronic conditions like heart disease, Alzheimer’s, and cancer, and a greater awareness of the need for elder care. Additionally, healthcare advancements have enhanced life expectancy, further contributing to the growing need for long-term care services.

North America dominates the nursing home care market, primarily due to an expanding elderly population, favorable government policies, and broader insurance coverage. Europe also holds a significant market share, supported by strong government-backed programs like Medicare and Medicaid.

Government programs, particularly Medicare and Medicaid in the United States, are essential in funding nursing home care for seniors who cannot afford private services. These programs greatly impact the availability and affordability of nursing home care, ensuring access for a wider population.

Nursing homes encounter several challenges, including staff shortages, increasing operational costs, and the difficulty of maintaining high standards of care amidst growing demand. Additionally, the shortage of qualified staff and the need for ongoing training further complicate care delivery.

Staffing levels are crucial to the quality of care provided in nursing homes. Shortages of trained professionals can lead to lower care quality, higher turnover rates, and potential neglect, negatively affecting residents’ health and well-being.

The nursing home care market is anticipated to grow as the elderly population expands, particularly in developed countries. Ongoing healthcare advancements, government support, and increasing focus on elder care drive the market’s growth.