Introduction

Skincare Statistics: In recent years, the skincare industry has experienced significant expansion fueled by growing consumer awareness, changing beauty ideals, and an increasing preference for personalized and natural products. Examining skincare statistics offers valuable insights into evolving market trends, consumer behavior, and buying patterns.

These statistics highlight changes in product demand, demographic involvement, and the rise of key segments, including anti-aging solutions, organic skincare, and men’s grooming products. By analyzing this data, industry participants can uncover new growth prospects, refine their marketing approaches, and better predict future market dynamics.

Editor’s Choice

- More than 20% of women include five or more products in their morning skincare routine, reflecting a growing trend toward personalized and multi-step beauty regimens.

- Women now devote an average of 22.4 minutes each day to skincare, showcasing the rising value placed on personal grooming and self-care as part of daily wellness.

- Although 73% of women use skincare products to combat aging signs like wrinkles and fine lines, only 15% believe these solutions deliver noticeable results, pointing to a gap between product claims and consumer satisfaction.

- Awareness of skincare ingredients remains limited, with only 21% of women knowing what goes into their products highlighting a growing need for transparency and consumer education.

- The adoption of AI-powered skincare has surged by 25%, and brands leveraging such technology for skin analysis have seen a 15% boost in user engagement, signaling increased demand for smart, tailored solutions.

- Generation Z, particularly those aged 18 to 24, are emerging as top spenders in skincare, with 41% prioritizing skincare purchases over other beauty products, indicating a shift toward proactive skin health and wellness.

- Around 74% of people maintain structured skincare routines, often distinguishing between morning and evening practices, which reflects a strong commitment to consistent skincare behaviors across generations…

(Source: World Heart Federation, National Institute of Health)

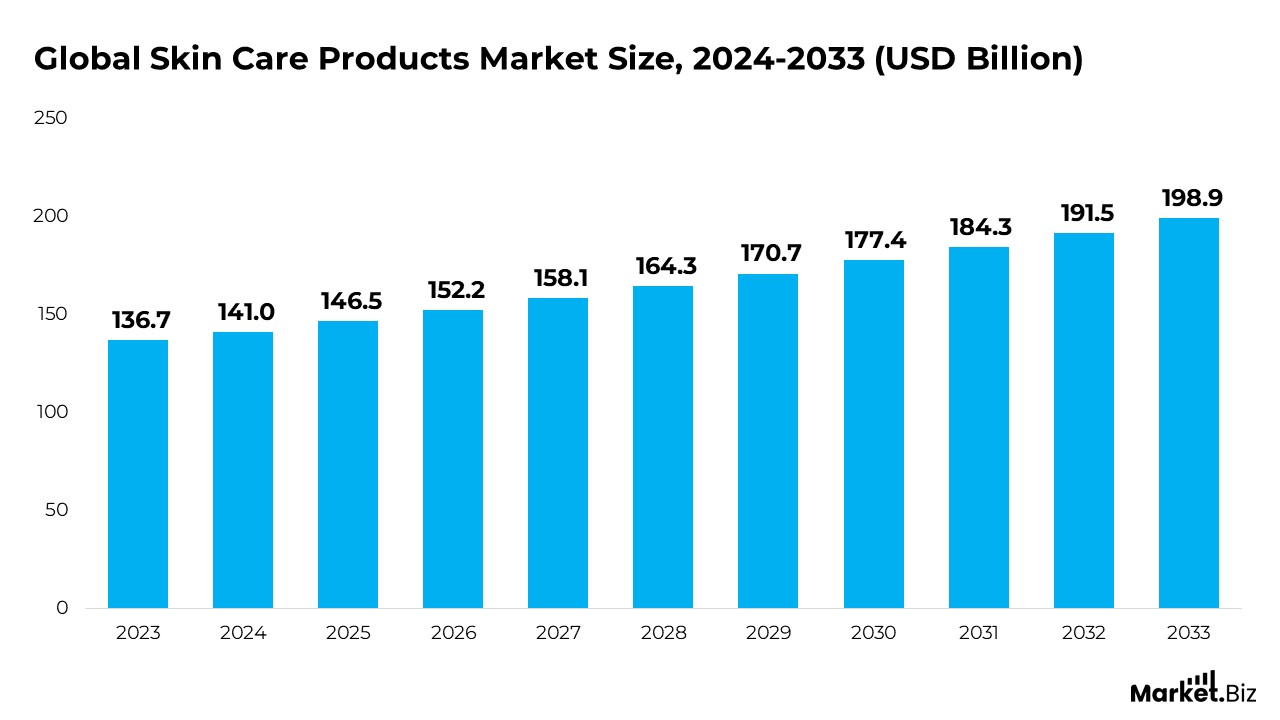

Global Skin Care Products Market Size

- As per Market.us, the global market for skin care products is anticipated to expand from $164.5 billion in 2025 to $191.5 billion by 2032, reflecting a compound annual growth rate (CAGR) of 3.9% from 2024 to 2033.

- The market’s expansion is largely fueled by increasing consumer preference for natural and organic ingredients, alongside ongoing technological innovations in skincare products.

- In 2023, women dominated the skincare product market, accounting for more than 68.5% of the total share. This growth is driven by women’s strong inclination toward advanced skincare treatments and the growing availability of customized products addressing various skin concerns and types.

- Face creams and moisturizers led the skincare segment 2023, capturing over 24.6% of the market. Their essential role in everyday skincare, combined with rising consumer demand for effective hydration, anti-aging benefits, and skin health, supports steady growth across premium and mass-market offerings.

- Supermarkets and hypermarkets represented the largest distribution channel in 2023, holding a 29.6% market share. This is due to their extensive reach and the convenience they provide to shoppers.

- North America held the largest skincare market share in 2023 at 31.7%, with a market value estimated at US$43.0 billion.

- This regional leadership stems from the high demand for innovative and premium skincare products, driven by an increasingly health-aware population and rising disposable incomes. The U.S. is a major contributor, witnessing strong premium and mass-market skincare growth, supported by growing consumer interest in natural and organic formulations.

(Source: Market.us)

Types of Skin Care Products

Consumer skincare routines are becoming increasingly varied, with distinct preferences for facial, body, and sun care products. Understanding these patterns is essential for brands aiming to meet diverse consumer needs.

Body Care

- Body lotions and creams lead the category, with 65% of consumers applying them regularly.

- Body washes and shower gels are also popular, used by 54% of consumers.

- Speciality products such as scrubs, body oils, and masks are increasingly adopted, with 38% incorporating them into routines.

(Source: Statista)

Facial Care

- Facial cleansers are the most commonly used facial products, with 72% of consumers using them regularly.

- Moisturizers and creams are widely incorporated, favoured by 68% of consumers.

- Anti-aging products like serums and creams appeal strongly to older consumers, with 47% of those aged 45 and above using them consistently.

(Source: Statista, Mintel)

Sun Care

- Sunscreen is deemed essential, with 59% of consumers applying it regularly.

- After-sun care products like soothing lotions and gels are used by 42% of consumers for post-exposure care.

- Facial serums and oils are gaining traction, with 45% of users including them in their routines.

- 37% of consumers use exfoliating scrubs or peels as part of their skincare regimen.

(Source: Statista, Mintel)

Analysis of Consumer Behavior and Current Trends in Skincare

Consumer Preferences for Skincare Products

Understanding which products consumers prioritize offers insight into daily skincare habits and market demand. Data highlights key favourites among users that shape product development and marketing strategies.

- Facial moisturizers remain the leading choice, with approximately 70% of consumers including them as a staple in their skincare regimen.

- Sunscreen is vital in skincare routines, with 59% of consumers consistently applying it to protect their skin from harmful UV exposure.

(Source: Statista, NPD Group, Market.us)

Skincare Purchasing Patterns

Analyzing consumer buying behavior provides crucial insights into preferred sales channels and purchase frequency, helping brands optimize distribution and engagement strategies.

- Approximately 58% of skincare buyers favour purchasing products from brick-and-mortar stores, while 42% opt for online platforms for convenience and variety.

- A survey revealed that 63% of consumers purchase skincare products at least once every month, indicating strong and consistent demand within the market.

(Source: Statista, Mintel)

Product Usage Patterns

- Facial moisturizers are the most widely used skincare products, with 70% of consumers incorporating them into their daily routines.

- Sunscreen also plays a crucial role, with 59% of users applying it regularly to protect their skin from sun damage.

(Source: NPD Group, Statista)

Brand Loyalty Dynamics

- Around 62% of skincare buyers exhibit loyalty toward specific brands.

- Within this group, 41% prioritize product quality and efficacy as the main reason for their continued preference, followed by brand trust (21%) and favourable reviews (18%).

(Source: Statista)

Factors Influencing Purchase Decisions

- Social media significantly impacts skincare trends, with 71% of consumers discovering new products through various platforms.

- Additionally, recommendations from friends, family, and influencers strongly affect purchasing choices, with 81% of consumers considering such reviews before buying.

(Source: Poshly, Mintel)

Rising Demand for Natural and Organic Products

- There is growing consumer interest in natural and organic skincare options, as 59% of respondents prefer such products.

- Furthermore, ingredient transparency is increasingly important, with 52% actively seeking products featuring clear, recognizable components.

(Source: Statista)

Preferences and Trends in Skincare Products and Formulations

- Consumer preferences in skincare are shifting toward effective ingredients and formulations tailored to diverse skin concerns.

- Hydrating and natural components and favored product textures and delivery formats are gaining prominence.

- Hyaluronic acid is a top ingredient globally, with the market projected to reach US$14 billion by 2032, driven by its moisturizing and anti-aging properties.

- Demand for natural and organic skincare products is increasing, with 59% of consumers preferring these formulations.

- Over 54% of consumers actively seek skincare products that have clean and transparent ingredient lists to ensure safety and efficacy.

- Creams and lotions remain the most popular formulations, preferred by 56% of consumers for their nourishing texture.

- Facial oils are growing in popularity, with 45% of consumers incorporating them into their skincare routines.

- Gel-based formulations, especially moisturizers and cleansers, are favoured for their lightweight, non-greasy feel.

- These trends highlight the need for brands to emphasize ingredient transparency and offer various formulation options to satisfy evolving consumer demands.

(Source: Statista, Market.us, Mintel)

Prevalent Skin Conditions and Concerns

Skin health challenges continue to drive consumer demand for targeted skincare solutions. Understanding the prevalence of key dermatological conditions helps brands develop effective products and address specific consumer needs.

Aging and Wrinkle Concerns

- Three-quarters of women over 40 express worries about skin and wrinkles laxity.

- In 2021, the worldwide anti-aging skincare market generated revenues of US$67.2 billion and is projected to reach approximately US$71.7 billion by the end of 2023.

(Source: Statista, Journal of Aesthetic and Clinical Dermatology)

Sensitive Skin

- Around 50% of people worldwide identify their skin as sensitive.

- This condition is more prevalent among women, accounting for about 60%, compared to roughly 40% of men.

(Source: Journal of Clinical and Aesthetic Dermatology)

Hyperpigmentation

- In the U.S., nearly 45% of the population experiences approximately hyperpigmentation.

- Melasma, a common pigmentation disorder, affects between 5 and 6 million Americans.

(Source: American Academy of Dermatology)

Acne

- Acne impacts roughly 9.4% of the world’s population, with a particularly high incidence among youth.

- About 85% of individuals aged 12 to 24 experience this condition.

(Source: American Academy of Dermatology, Global Burden of Disease Study)

Dry Skin

- Dry skin is widespread, affecting about half of the worldwide population.

- In the U.S., eczema, which often causes dry skin, affects approximately 7.8 million children and 17.5 million adults.

(Source: National Eczema Association, International Journal of Cosmetic Science)

Rosacea

- Rosacea impacts a projected 16 million individuals in the U.S. and affects approximately 415 million globally.

(Source: Journal of the American Academy of Dermatology)

Psoriasis

- Psoriasis affects about 2-3% of the worldwide population, with roughly 7.5 million diagnosed cases in the U.S. alone.

(Source: National Psoriasis Foundation)

Trends in Skin Care Routine

Daily Skincare Routine Practices

- Skincare routines have become a consistent part of daily life for many individuals, reflecting growing awareness about skin health.

- A recent survey indicates that 62% of men and 82% of women adhere to a regular skincare regimen. Moisturizing and cleansing are the most common steps, incorporated by 85% of women and 67% of men in their everyday routines.

(Source: Statista)

Popularity of Multistep Skincare Regimens

- Inspired largely by the Korean beauty (K-beauty) phenomenon, multistep skincare routines have gained widespread popularity across the globe.

- Research shows that 66% of women in the U.S. and an even higher 81% of women in South Korea follow comprehensive multistep skincare protocols, underscoring the global appeal of this trend.

(Source: Mintel)

Time Investment and Expenditure on Skincare

- Consumers are dedicating notable time and financial resources to their skincare. Women spend approximately 13 minutes daily on their skincare routine, compared to around 9 minutes for men.

- Reflecting this commitment, global expenditure on skincare products reached an estimated US$134.8 billion in 2021, highlighting the sector’s substantial economic impact.

(Source: Statista)

Influence of Skincare Personalities on Social Media

- Social media influencers specializing in skincare on platforms like YouTube and Instagram have significantly impacted consumer habits and product preferences.

- A survey found that 60% of beauty enthusiasts in the U.S. have purchased skincare items based on influencer recommendations.

(Source: Forbes)

Key Players in Skin Care

L’Oréal

- L’Oréal stands as one of the largest and most renowned skincare brands globally.

- In 2023, its skincare and cosmetics division generated a remarkable revenue of €14 billion (approximately US$44.5 billion), underscoring its leadership position in the market.

(Source: L’Oréal Annual Report, Statista)

Estée Lauder

- Estée Lauder is a well-known name in the skincare and cosmetics sector.

- During the fiscal year 2021, Estée Lauder Corporation stated total sales of US$14.29 billion, encompassing well-known brands such as Clinique, Estée Lauder, and La Mer within its portfolio.

(Source: Estée Lauder Companies Annual Report)

Olay

- Olay, a well-established skincare brand held by Procter & Gamble, contributes to P&G’s extensive portfolio.

- In the fiscal year 2021, P&G reported net sales of US$76.1 billion, reflecting the broad market reach of its various brands, including Olay.

(Source: Procter & Gamble Annual Report)

Conclusion

Skincare statistics demonstrate a dynamic market continuously shaped by varied consumer demands, heightened awareness, and ongoing advancements in product development. Key issues like aging, acne, and sensitive skin significantly fuel the need for targeted and effective treatments.

Growing consumer preference for natural and organic products and the expanding influence of digital platforms and social media are transforming buying patterns. These trends present valuable opportunities for brands to innovate and customize their products to satisfy the evolving needs of modern skincare users. As the global skincare market expands, closely monitoring these data-driven insights will be essential for maintaining competitive strength and achieving long-term growth.

FAQ’s

The skincare market is expanding due to heightened consumer awareness, increasing demand for personalized and natural formulations, ongoing technological innovations, and growing attention to skin health issues like aging and acne.

Facial moisturizers top the list of commonly used products, with roughly 70% of individuals incorporating them into their daily regimen. At the same time, sunscreens are also widely favoured, with 59% of users applying them regularly.

Trends in skincare are heavily influenced by social media platforms, endorsements from influencers, and word-of-mouth recommendations, as consumers often rely on these sources to discover and decide on new products.

Brand loyalty plays a significant role, with about 62% of consumers sticking to preferred skincare brands, largely motivated by consistent product performance, trustworthiness, and positive customer feedback.

There is a marked shift toward natural and organic skincare, with nearly 59% of consumers showing a clear preference for products containing transparent, clean-label ingredients.

The primary skin concerns influencing product demand include acne, signs of aging like wrinkles, hyperpigmentation, dryness, and sensitivity, and conditions such as rosacea and psoriasis, prompting targeted skincare solutions.