Introduction

Smartwatch Statistics: In recent years, the smartwatch market has experienced significant growth, driven by advancements in technology, shifting consumer preferences, and an increased emphasis on health and fitness. What was once a simple timekeeping device has now evolved into a versatile tool for tracking a wide range of health metrics, including heart rate, sleep quality, and blood oxygen levels. This shift has broadened the appeal of smartwatches to a diverse group of consumers, from fitness enthusiasts to tech-savvy individuals and those seeking comprehensive health monitoring.

Ongoing improvements in features such as longer battery life, more sophisticated sensors, and enhanced integration with other smart devices are making smartwatches an essential part of daily life. The growing use of wearables in both personal and professional settings underscores the increasing awareness of health and wellness, thereby driving the market’s expansion.

Editor’s Choice

- By 2025, the global number of smartwatch users is projected to reach 454.69 million, reflecting a 41% growth from 323.99 million in 2023.

- As of 2022, approximately 30% of smartwatch users utilize their devices for contactless payments through platforms such as Google Pay and Apple Pay.

- More than 60% of consumers identify battery life as one of the most important criteria when selecting a smartwatch.

- The adoption of smartwatches among US adults rose from 18% in 2019 to 23% by 2021.

- In 2021, Apple dominated the smartwatch market with a 34.4% share of global shipments, followed by Samsung with 8.3% and Garmin with 7.9%.

(Source: Dermandsage, Statista, International Data Corporation)

Global Smartwatch Market Size

- According to Market.us, the global smartwatch market is estimated to grow from $50.4 billion in 2025 to $122.2 billion by 2032, representing a compound annual growth rate (CAGR) of 13.5% from 2023 to 2033.

- The growth of the smartwatch market is driven by technological innovations, shifting consumer preferences, and an increasing emphasis on health and fitness.

- In 2023, Android-based smartwatches maintained a leading market position, securing more than 37.7% of the total market share. The widespread popularity of Android smartphones has naturally led to a growing inclination among consumers towards Android-compatible smartwatches.

- The Communication segment led the smartwatch market in 2023, representing over 35.0% of the market share. Smartwatches with communication capabilities, including calling, messaging, and social media alerts, have become essential for real-time connectivity.

- North America emerged as the dominant region in the smartwatch market in 2023, accounting for over 39.4% of the market share. High smartphone adoption, robust technological infrastructure, and increasing awareness of health and fitness contributed to the region’s leadership.

(Source: Market.us)

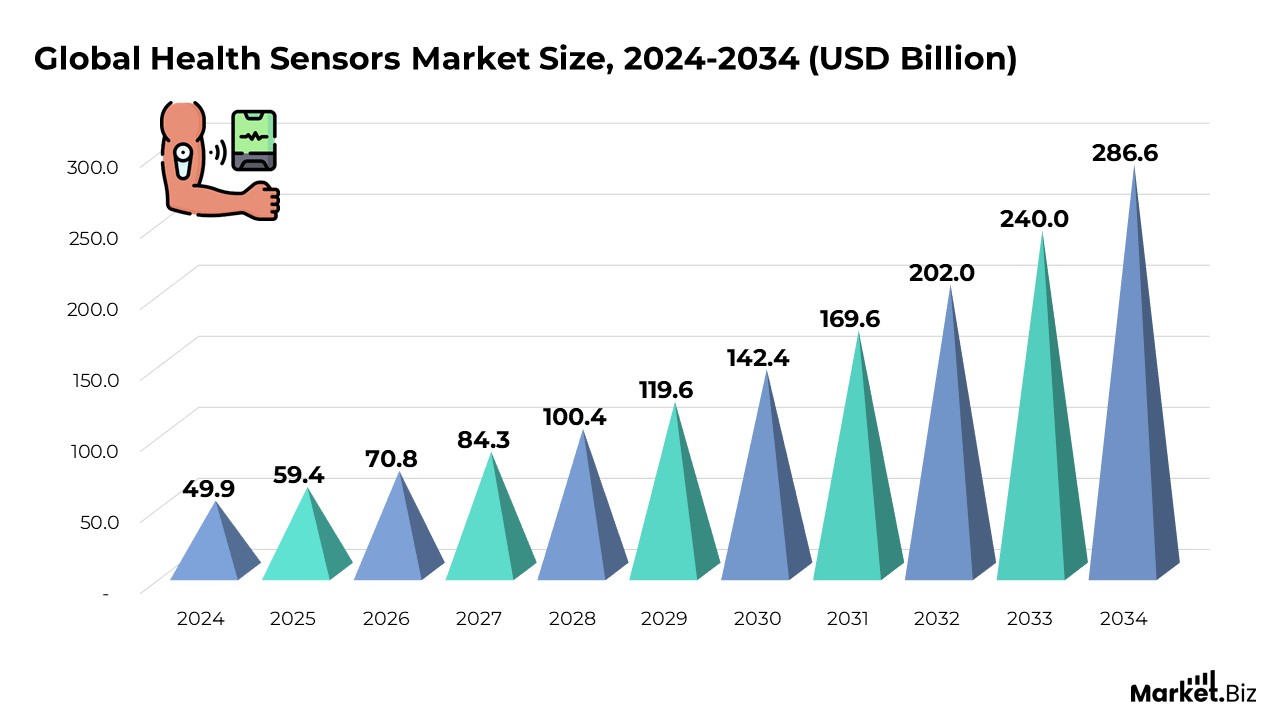

Global Health Sensors Market Size

- According to Market.us, the global health sensors market is projected to grow from $59.4 billion in 2025 to $286.6 billion by 2034, representing a compound annual growth rate (CAGR) of 19.1% from 2024 to 2034.

- Increased awareness of lifestyle-related health issues is driving demand for sensors that monitor vital signs, activity, and sleep.

- The heart rate sensors segment held a 39.7% market share, driven by increasing awareness of cardiovascular health and the adoption of wearable fitness devices.

- Wearable sensors captured 57.3% of the market, driven by the demand for real-time health tracking and the need for portability in proactive health management.

- The chronic illness & at-risk monitoring segment grew significantly, with a 40.4% revenue share, fueled by the global rise in chronic diseases and a focus on early detection.

- The hospitals & clinics segment saw substantial growth, generating 44.6% of revenue, due to greater integration of health sensors for patient care and operational efficiency.

- North America led the market, accounting for the largest revenue share of 37.4%, driven by a focus on personal health monitoring and the rising incidence of chronic conditions.

(Source: Market.us)

General Smartwatch Statistics

- It was projected that around 225 million people worldwide would use smartwatches by 2024, with steady growth anticipated in the years to come.

- Approximately 60% of smartwatch users now rely on their devices for fitness tracking, with key features like sleep analysis, heart rate monitoring, and step counting being particularly popular.

- Apple maintains its leadership in the smartwatch market, capturing more than 52% of global smartwatch shipments.

- Many modern smartwatches are equipped with heart rate sensors, and some have even received FDA approval to detect irregularities, such as atrial fibrillation, which is a significant risk factor for stroke.

- In 2022, 92% of smartwatch users in the US primarily used their devices for health tracking, underscoring the growing dependence on smartwatches for monitoring various health metrics.

- With technological advancements, an increasing number of people are turning to smartwatches to manage chronic conditions and detect symptoms of severe illnesses. However, just 12% of individuals earning less than $30,000 annually currently use this technology.

- In Australia, the adoption of smartwatches is on the rise, with 36% of the population using them for health monitoring as of 2023.

(Source: Statista, Campaign, Deloitte, Statista, The New England Journal of Medicine, Electro IQ)

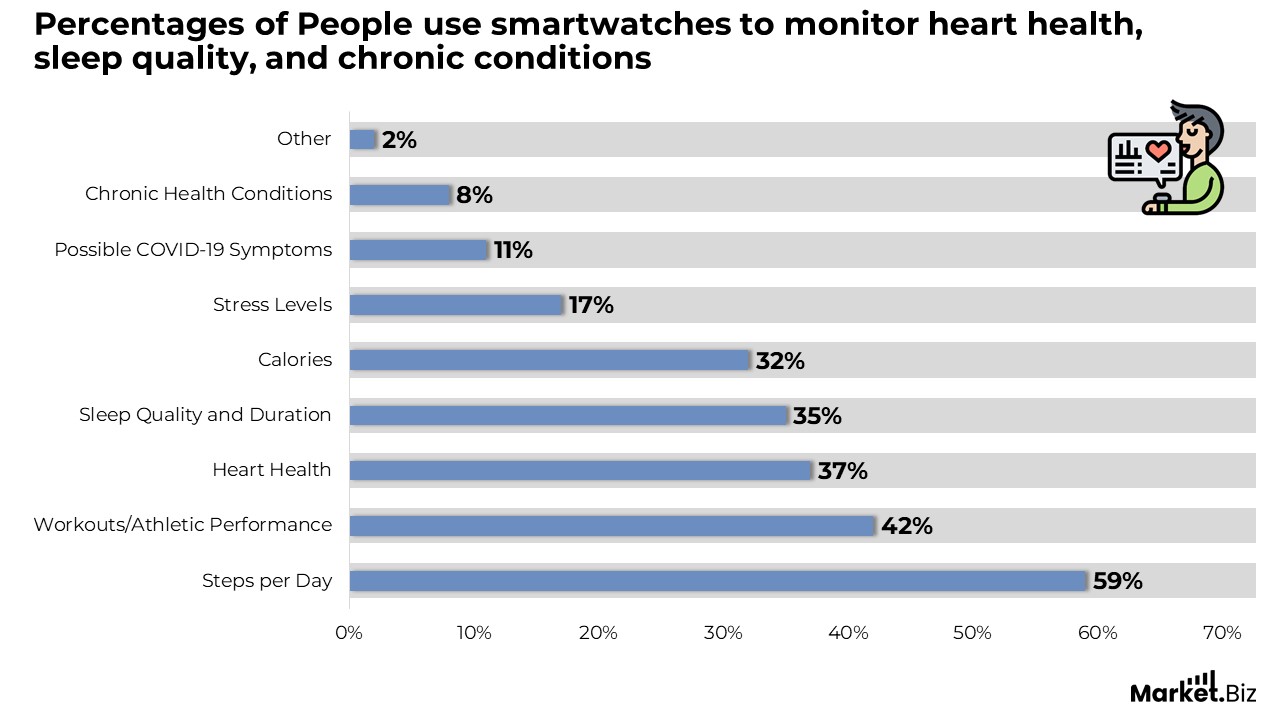

What do Users Measure with a Smartwatch?

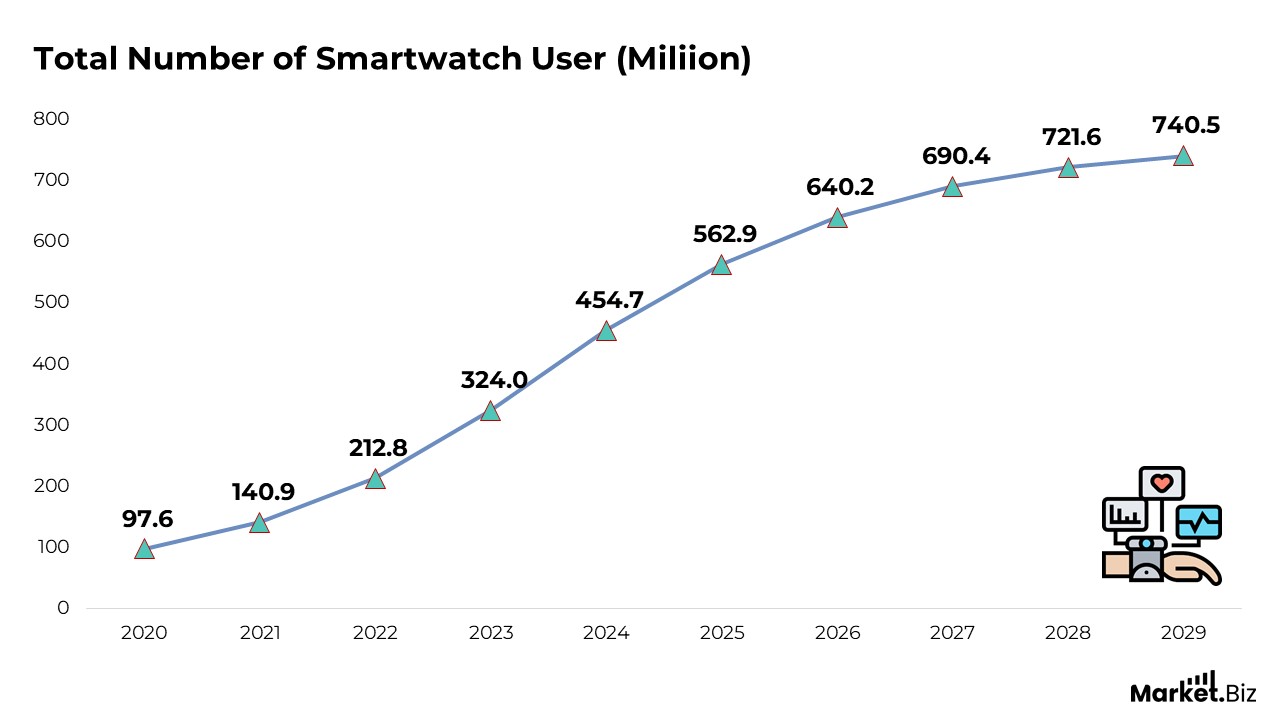

Smart Watch Users Statistics

- There are 454.69 million smartwatch users worldwide as of 2025, marking a 41% increase from the 323.99 million users in 2023.

- The number of smartwatch users is expected to continue rising, reaching an estimated 740.53 million by 2029.

(Source: Statista, Demandsage)

Smartwatch Sales

- In 2023, an estimated 184 million smartwatches were projected to be sold, reflecting a 16% increase from the 173 million units shipped globally in 2022.

- India is expected to drive much of this growth, with demand in the country predicted to surge by 75%.

- Despite a 7% decline in sales in 2022, leading brands such as Apple, Garmin, Google, and Samsung continue to dominate the global smartwatch market. Sales of these advanced smartwatches were forecasted to remain steady at 107 million units in 2023

(Source: Demandsage, CCS Insights, Electro IQ)

Demographics of Smart Watch Users

Age

- In the 16 to 24-year-old age group, 19.6% of females and 21.0% of males own a smartwatch. This generation is deeply engaged with technology, primarily using smartwatches for fitness tracking and social media updates, aligning with the broader trend of increasing wearable device adoption among younger users.

- For those aged 25 to 34, 27.2% of females and 26.9% of males use smartwatches. This age bracket tends to integrate technology seamlessly into daily life, leveraging smartwatches for both productivity and health-focused applications.

- Among 35 to 44-year-olds, 24.5% of females and 25.5% of males own a smartwatch. This demographic appreciates the practicality and versatility of smartwatches, using them to monitor health data, stay on top of schedules, and remain connected with others.

- In the 45 to 54 age group, 18.6% of females and 20.9% of males possess smartwatches. This cohort is increasingly relying on wearables to track their health, with a strong emphasis on heart rate monitoring and other wellness features.

- For the 55 to 64-year-olds, 12.7% of females and 16.1% of males own smartwatches. Although adoption is lower in this group, smartwatches are gaining traction for their health-related functions, including heart rate tracking and medication reminders.

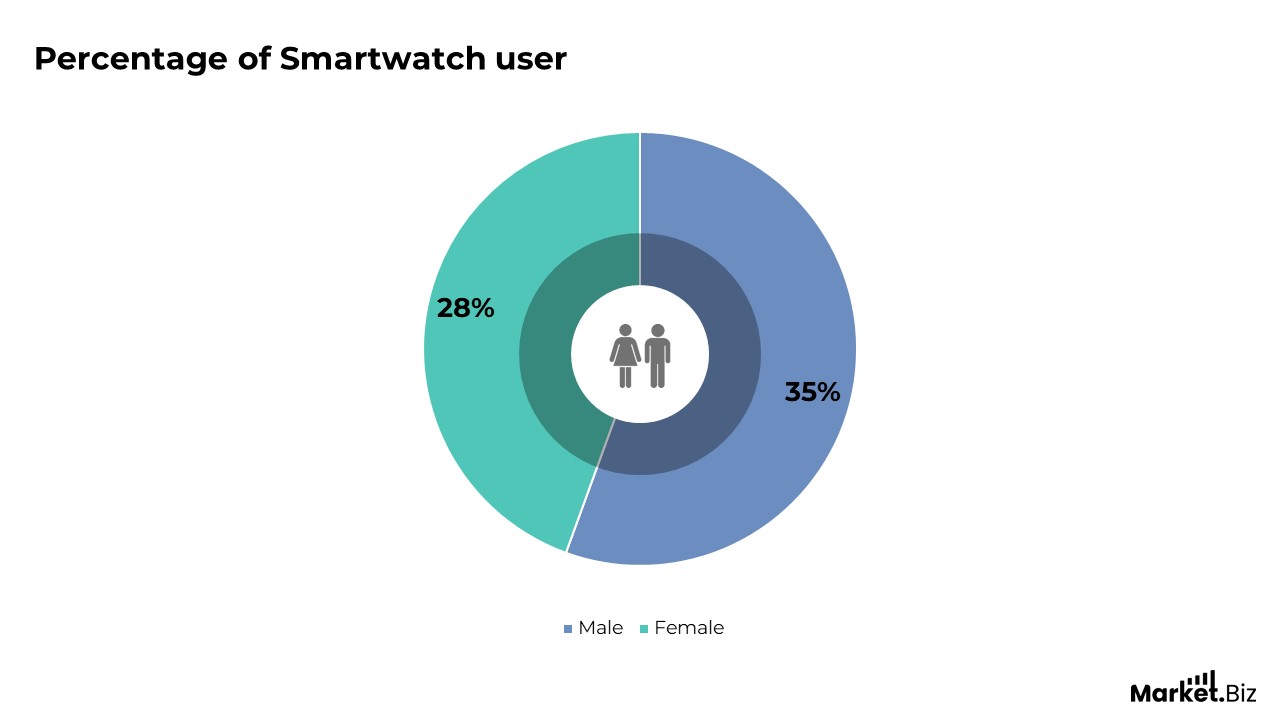

Gender

(Source: Electro IQ, Datareportal)

Race

- 26% of Hispanics own a smartwatch. This group is increasingly embracing wearable technology, with many individuals using smartwatches to track their fitness, monitor their health, and stay connected throughout the day.

- Twenty-three per cent of Black individuals own a smartwatch. The growing adoption of wearables in this group reflects a heightened focus on health and wellness, as well as a desire to integrate technology into daily routines for convenience and efficiency.

- 20% of White individuals own a smartwatch.

(Source: Pew Research Center)

Usage

(Source: Demandsage)

Smartwatch Impact on Health and Fitness

- Over 60% of smartwatch users utilize their devices to track physical activity and overall health.

- More than 70% of smartwatch owners report that their devices have motivated them to live healthier and exercise regularly.

- Approximately 55% of smartwatch users track their sleep patterns, utilizing this feature to enhance their sleep quality and cultivate healthier sleep habits.

- Approximately 40% of smartwatch owners utilize the SpO2 tracking feature to measure their blood oxygen levels, which is a crucial indicator of respiratory health, particularly for individuals with pre-existing health conditions or those engaging in strenuous physical activities.

- Approximately 25% of smartwatch users utilize the electrocardiogram (ECG) functionality, enabling them to monitor their heart health and identify potential issues, such as atrial fibrillation.

- Over 10% of users track their blood glucose levels through smartwatches, a beneficial feature for those managing diabetes or aiming to maintain healthy blood sugar levels.

- Step-counting features are utilized by 90% of smartwatch users, underscoring the widespread appeal of fitness tracking and the growing emphasis on physical activity.

- Nearly 50% of smartwatch owners monitor their calorie intake and expenditure, which helps users make more informed decisions about their diet and overall nutrition.

- Thirty-five per cent of female smartwatch users track their menstrual cycles, utilizing the device to monitor ovulation, symptoms, and overall reproductive health.

- Around 40% of smartwatch users report an increase in exercise frequency, encouraged by reminders, fitness tracking, and motivational features designed to promote an active lifestyle.

- Twenty-five per cent of users report weight loss benefits from using wearables, as the tracking features help them manage their weight and achieve fitness objectives.

- Approximately 70% of smartwatch users continue using their devices beyond one year, demonstrating the lasting value and ongoing engagement these wearables offer in supporting long-term health and fitness goals.

(Source: Consumer Technology Association, Pew Research Center, Patent PC)

Health Data Sharing Via Smart Devices

A 2024 study in the southeastern United States, which surveyed 1,368 patients from an academic health system, focused on smart device usage and patients’ willingness to share their health data. The following were key findings:

- 98% of respondents had a smartphone, and 59% owned a wearable device, including smartwatches.

- Wearable ownership was more common among females, Hispanic persons, Generation Z (ages 18-25), those with advanced education, and full-time employees.

- Half of the smart device holders were willing to share their health data for research resolutions, with 32% considering doing so.

(Source: National Institute of Health)

Smartwatch Users – By Country

- According to the Rock Health Digital Health Consumer Adoption Survey 2023, 44% of people in the US use wearable health tracking devices, such as smartwatches or smart rings, which track various health metrics, including sleep patterns and heartbeats.

- About 31% of Americans from households earning $75,000 or more annually report regularly wearing a smartwatch or fitness tracker, while only 12% of those with household incomes below $30,000 do the same.

| Country | Percentage of Internet Users Using Smartwatches |

|---|---|

| Poland | 26.5% |

| China | 20.9% |

| United Kingdom | 15.0% |

| Germany | 14.5% |

| India | 13.8% |

| United States | 12.2% |

| France | 12.1% |

| Japan | 2.4% |

| Morocco | 2.1% |

(Source: RockHealth, Pew Research Center, Demandsage)

Common Issues with Smartwatches

- Battery life challenges

- Synchronization problems

- Weak Bluetooth connection

- Software malfunctions or frozen display

- Unresponsive touch functionality

- App crashes

- Missed important notifications

(Source: Croma, Parks Associates, Hammer)

Recent Developments

New Product Launches

- In June 2025, it introduced the Alpha 3, featuring a large 1.5-inch round display and a sleek, premium bezel design. Custom-made for those who prefer their tech to be sleek, functional, and straightforward, the Alpha 3 delivers essential features without unnecessary complexity.

- In May 2024, Fastrack unveiled the Fastrack Xtreme Pro, designed to tackle any challenge. Crafted for an active and fashionable lifestyle, the Fastrack Xtreme Pro is equipped with a range of features to enhance your daily adventures.

Deployment Milestones:

- Fossil Group, Inc. achieved a significant milestone in 2023 by surpassing 1 million smartwatch sales worldwide, driven by the strong popularity of its Fossil Gen 6 and Skagen Falster collections.

Technological Advancements:

- Huawei Technologies Co., Ltd. has launched the Huawei Watch GT 3 series, which utilizes cutting-edge health-tracking sensors and AI-driven algorithms to deliver in-depth fitness and wellness insights to its users.

Investment in Research and Development:

- Amazfit, a brand under Huami Corporation, committed $100 million to research and development efforts aimed at advancing smartwatch technology, with a focus on enhancing battery life, sensor precision, and software optimization.

Conclusion

Smartwatches have become a widely popular and multifunctional tech accessory, offering various features that meet the diverse needs of consumers. With capabilities like fitness tracking, health monitoring, communication tools, and app integrations, smartwatches have seamlessly integrated into many people’s daily routines.

The market has experienced considerable growth, driven by technological advancements and a growing consumer focus on health and wellness. As the industry evolves, smartwatches are anticipated to play a key role in shaping the future of wearable technology.

FAQ’s

The smartwatch market is expanding due to advancements in technology, growing consumer interest in health and fitness tracking, and the increasing role of smartwatches in everyday life. Consumers are becoming more aware of the health benefits these devices provide, which is further fueling their popularity.

Emerging markets, particularly India, are experiencing the highest demand for smartwatches, with significant growth anticipated in the years to come. North America and Europe also remain key regions with strong sales, maintaining a dominant presence in the global market.

Smartwatches are primarily driven by features such as fitness and health tracking (including heart rate monitoring, step counting, and sleep analysis), communication capabilities (calls, messages, and notifications), and app integrations. These functionalities make smartwatches indispensable for both daily activities and health management.

Apple, Google, Garmin, and Samsung are the leading brands in the global smartwatch market. Despite facing some sales declines in 2022, these companies continue to lead, with Apple holding the largest share of global smartwatch shipments.

Smartwatches play a crucial role in health monitoring by tracking vital signs, including heart rate, sleep patterns, blood oxygen levels, and physical activity. Some models also offer advanced features, such as ECG monitoring and fall detection, which help users manage chronic health conditions and identify potential health concerns.